(Grainscape | Pulse | Strategic Capital Allocation)

As the founder of two data-driven DTC ventures, I oversaw capital deployment, operational strategy, and financial performance across the entire business lifecycle. My focus extended beyond product design — into unit economics, capital structure modeling, and valuation-informed decision-making.

These ventures allowed me to apply investment banking logic and financial control across P&L oversight, breakeven modeling, and scenario-based capital strategy.

Capital Strategy & Financial Oversight

Developed a performance-led investment model across Grainscape and Pulse, focused on minimizing CAC, maximizing LTV, and achieving healthy gross and EBITDA margins.

- Allocated ad budgets across Meta, YouTube, and TikTok with emphasis on ROAS and breakeven payback windows

- Built financial models to analyze margin contribution, cost per conversion, and campaign-level capital efficiency

- Optimized unit-level profitability and refined unit-level economics through optimized COGS modeling and fulfillment chain efficiency.

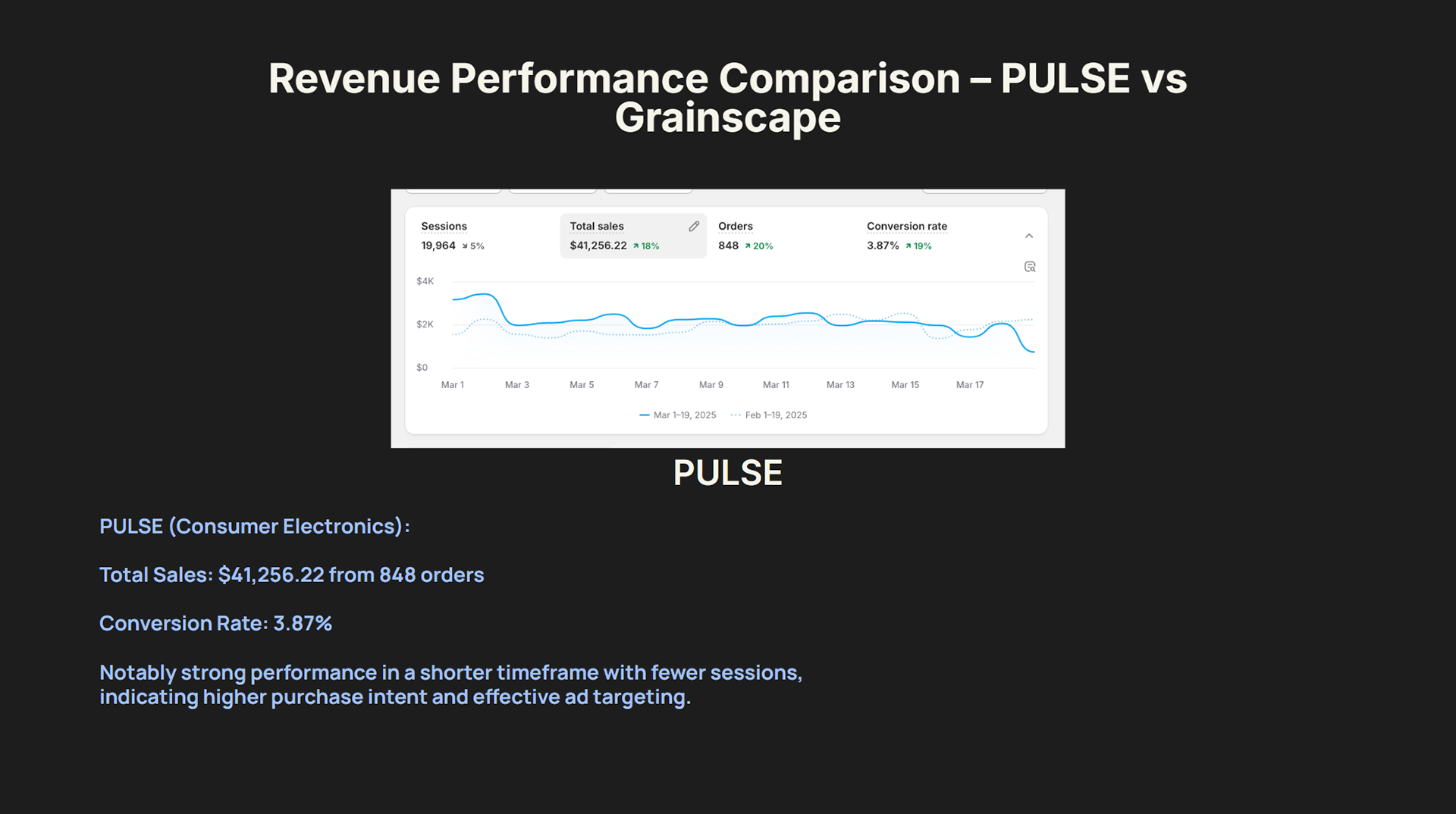

Snapshot of Pulse’s key financial performance metrics. Highlights include a 79% gross margin and 60% EBITDA margin driven by lean COGS, disciplined marketing spend (20% of revenue), and strong unit-level profitability. Implied valuation estimated at ~$147k using a 6x EBITDA multiple.

Ad Spend Allocation & Investment Performance

Oversaw capital distribution across ad channels using A/B testing and cross-platform benchmarking. Leveraged conversion funnel data to fine-tune spend strategy and maintain efficient scaling thresholds.

- Tracked ROI, CTR, CPA, and platform-level volatility

- Implemented ROIC tracking per campaign cycle

- Converted campaign performance into executive-style dashboards with capital return metrics, breakeven periods, and forward spend thresholds

Directed capital deployment across Meta, Google, and TikTok with performance-driven allocation strategy. Utilized A/B testing, CTR/CPA benchmarking, and funnel data to optimize unit economics and protect margin thresholds. Implemented ROIC tracking across campaign cycles, consolidating performance metrics into investment-style dashboards for strategic reinvestment decisions.

Strategic Summary & Investor Insight

Across both ventures, investment strategy was grounded in scenario modeling, predictive analytics, and financial oversight. These tools shaped everything from pricing models to future capital deployment decisions.

Pulse: Capital-efficient scaling with higher ROAS per user and 2x CAC-to-revenue return

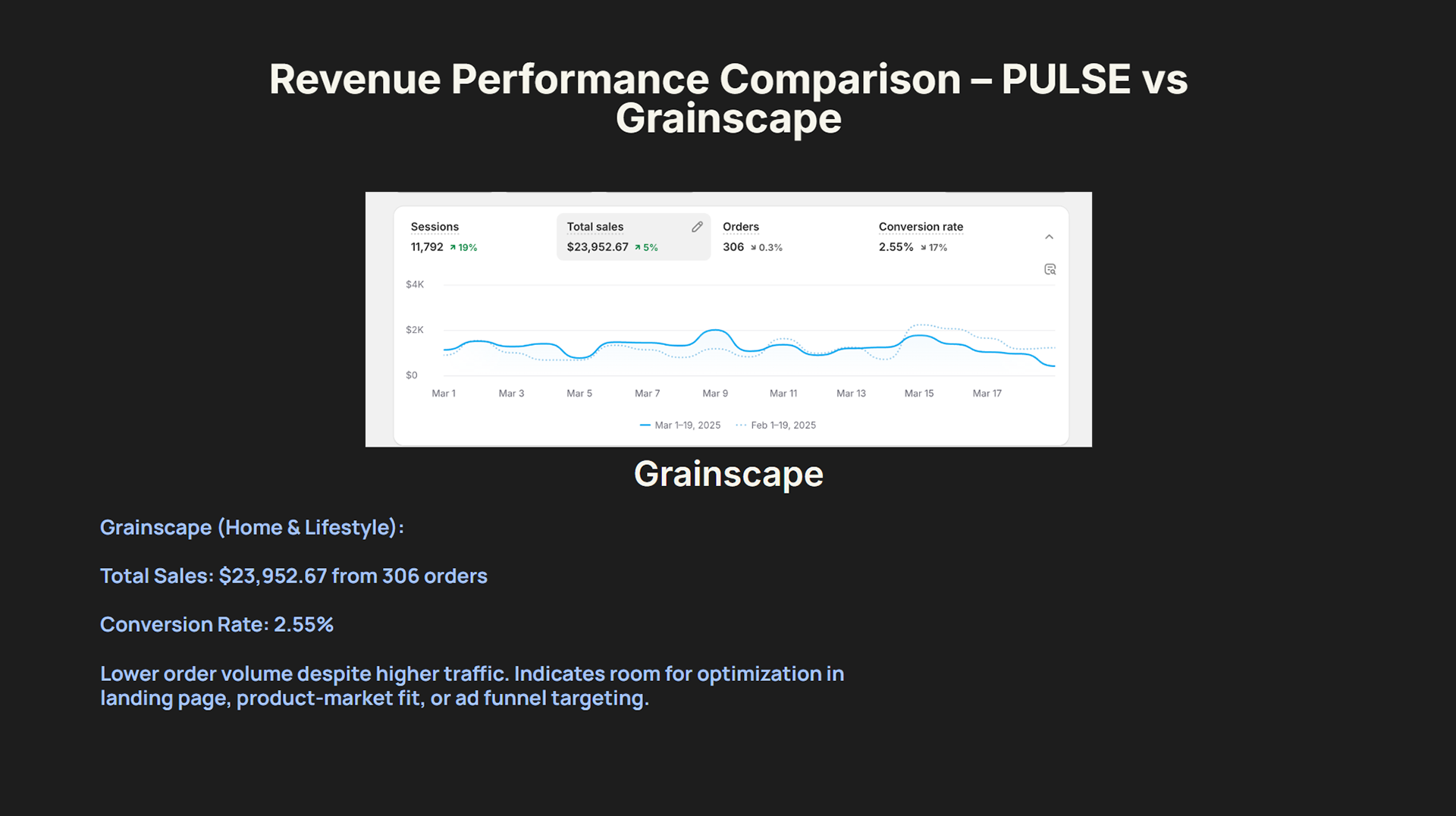

Grainscape: Longer LTV tail, stronger gross margins, but lower session conversion efficiency

Outcome: Combined deck modeled investment case across both brands with forward EBITDA projections

Pulse demonstrated a lean, scalable DTC model with strong unit economics, efficient CAC deployment, and margin resilience. The brand’s performance profile — including 79% gross margin and 60% EBITDA margin — reflects a capital-efficient growth model. Insights derived from platform-level ROI, user behavior trends, and conversion efficiency provided key inputs for potential valuation modeling, capital deployment strategy, and investment decision frameworks.

"These experiences sharpened my ability to think like an investor — applying return-focused logic to business operations, building scalable financial models, and executing with capital discipline across fast-moving verticals."